The EURUSD was indecisive yesterday. I found something interesting about the CCI behavior on h4 chart below. Here is the situation: Price still move in bullish channel, indicating we are in bullish phase, but corrected lower from 1.3332 to 1.2782. Now look at my CCI. The A part show that the bullish gained its momentum back after being in oversold area and cross the -100 line up. The B part show that CCI cross the -100 line up, but the bearish pressure didn't stop and price keep under bearish pressure. Now we are in the C part, where CCI also in oversold area and cross the -100 line up. Learning from past experience, from here the bullish and bearish scenario probability is 50-50. Although we are seeing some upside pressure now, my bullish mode will be reactivated at least when price able to move consistently above 50% Fibo retracement of 1.3332 - 1.2782 which is located around 1.3057. Now, let's look at the intra-day. Immediate resistance around 1.2880 - 1.2900 area. Consistent move above that area could trigger further upside pressure testing 1.2980 - 1.3000. Initial support at 1.2782. Break below that area could trigger further bearish pressure testing 1.2700/35 and the lower line of the bullish channel and could be a serious threat to the bullish outlook.

EUR/USD Daily Forecast

Posted by T.Jagat at 12:52 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY was technically a mess yesterday. I have no significant chart patterns that could show me the direction in nearest term. After violated the bullish channel, the direction should be more to the downside, but we have a very strong support around 109.20 area as you can see on my h1 chart below. Consistent move above 110.70 could trigger further upside pressure testing 111.50/60 area. On the downside we need a clear break below 109.20 to continue the bearish pressure testing 108.07 - 107.30 area.

GBPJPY Daily Forecast

The GBPJPY was volatile but indecisive yesterday. On h1 chart below we can see that the minor bearish channel (red) has been violated to the upside indicating potential upside pressure in nearest term testing 135.50 but note that unless price break above the major bearish channel (white) the bearish scenario remains intact. Immediate support at 133.70 followed by 132.98 (yesterday's low).

AUDUSD Forecast

The AUDUSD was indecisive yesterday, formed a Doji on daily chart indicating consolidation. The bias is neutral in nearest term but overall we are still in major bullish outlook. Immediate resistance at 0.9040. Break above that area could trigger further upside pressure testing 0.9145 and could be an early sign of bullish continuation. Initial support remains around 0.8858 area. Break below that area could be a serious threat to the current bullish outlook.

Posted by T.Jagat at 12:50 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD had a moderate bearish momentum yesterday. On h1 chart we have a falling wedge formation indicating potential upside scenario especially if price break above the formation testing 1.5735. But the real bullish mode will be reactivated only of price able to move above the trendline resistance (yellow) which also the 50% Fibo retracement of 1.5992 - 1.5564 around 1.5775, retesting 1.6000 region. Immediate support at 1.5550. Break below that area could be a serious threat to the current bullish outlook.

Posted by T.Jagat at 12:48 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY was bullish yesterday after rejected to move consistently below 84.82/73. The bias is bullish in nearest term testing 87.00 and the trendline resistance area but we need a clear break above 86.25 resistance area to continue the upside pressure. Note that overall we are still in major bearish outlook, but need a clear break below 84.82/73 to continue the bearish scenario testing 83.35. I will stand aside for now.

Posted by T.Jagat at 12:46 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF failed to continued its bullish momentum yesterday, bottomed at 1.0464 and closed at 1.0497. Overall we are still in range area of 1.0675 - 1.0350 and need a break on either side to see clearer direction. Immediate support at 1.0450. Break below that area could trigger further bearish pressure testing 1.0350. Initial resistance at 1.0600 followed by 1.0675. I will stand aside for now.

Posted by T.Jagat at 12:45 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD had a huge bearish movement yesterday, bottomed at 1.2859 and closed at 1.2862. On daily chart below we can see that after failed to move above 1.3340 resistance area, the Euro has been under heavy pressure and now price seems ready to test the lower line of the bullish channel, which is located around 1.2700 area, especially if price able to move consistently below 1.2800. Break below 1.2700 and violation to the bullish channel could be seen as bullish failure and potential bearish reversal scenario at least testing 1.2470. Immediate resistance at 1.2920 followed by 1.2980 - 1.3000 area. Break above that area should keep the bullish scenario intact.

Posted by T.Jagat at 12:40 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY continued its bearish momentum yesterday, bottomed at 109.65 and closed at 109.74. The bias remains bearish in nearest term testing 108.07 - 107.30 area. Immediate resistance at 110.00 followed by 110.70. Break above 110.70 could lead us into neutral zone in nearest term but the main scenario remains to the downside.

GBPJPY Daily Forecast

The GBPJPY also continued its bearish pressure yesterday, bottomed at 132.79 and closed at 133.58. On h1 chart below, as a result of huge bearish pressure, we have a new sharper bearish channel indicating strong bearish momentum. The bias remains bearish in nearest term testing 132.00 region. Immediate resistance at 133.70. Break above that area could lead us into neutral zone in nearest term but overall we are still in a strong bearish scenario.

AUDUSD Forecast

The AUDUSD had a significant bearish momentum yesterday, bottomed at 0.8966 and closed at 0.8969. Although overall the major bullish scenario remains intact, it is surely under a serious threat since we have the rising wedge formation. To ignore this bearish reversal warning is foolish. The bias is bearish in nearest term testing key support area 0.8858. Break below that area could trigger further bearish pressure testing 0.8715 region. Immediate resistance at 0.9040. Break above that area could lead us into neutral zone in nearest term.

Posted by T.Jagat at 12:39 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

USD/JPY Daily Forecast

The USDJPY attempted to push lower yesterday, bottomed at 84.73 but closed higher at 85.32. The bias is neutral in nearest term but still within a strong bearish context. Another move below 84.82/73 region could continue the bearish pressure testing 83.35 area. Immediate resistance at 85.50 and the minor trendline resistance (blue). Break above that area could trigger further upside pullback testing 86.25 but I still prefer short on rallies strategy at this phase.

Posted by T.Jagat at 11:49 AM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

GBP/USD Daily Forecast

The GBPUSD also had a significant bearish momentum yesterday, bottomed at 1.5628 and closed at 1.5656. On daily chart below we can see that the Sterling has been under huge pressure after failed to move above 1.6000 psychological level and now seems ready to test the lower line of the bullish channel which is located around 1.5550 area. Break below that area and violation to the bullish channel could be seen as bullish failure and potential bearish reversal testing 1.5250. Immediate resistance at 1.5735 followed by 1.5800. Break above that area should keep the bullish scenario intact.

Posted by T.Jagat at 11:48 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/CHF Daily Forecast

The USDCHF had a bullish momentum yesterday, topped at 1.0601 and closed at 1.0589. The bias is bullish in nearest term testing 1.0675 but note that overall we are still in consolidation phase. Break above 1.0675 could be seen a a serious threat to the bearish scenario testing 1.0837/50 area. Immediate support at 1.0500 - 1.0480. Break below that area could area could lead us into neutral zone in nearest term.

Posted by T.Jagat at 11:47 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

Gold Extending Weakness

In 240 minutes chart, Gold has topped. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. The 3 wave correction may be complete just shy of its 100% extension. I am exceptionally bearish gold from here.

Posted by T.Jagat at 12:41 PM 0 comments

Labels: gold trading, metal

USD/CHF Daily Forecast

The USDCHF attempted to push higher yesterday, topped at 1.0617 but whipsawed to the downside and closed lower at 1.0484 in a high volatile market. The bias is neutral in both nearest and medium term as price still consolidating in range area of 1.0675 - 1.0350. Immediate resistance at 1.0580. Break above that area could trigger further upside pressure testing 1.0675. Initial support at 1.0450. Break below that area could trigger further bearish pressure testing 1.0350.

Posted by T.Jagat at 12:03 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

USD/JPY Daily Forecast

The USDJPY attempted to push higher yesterday, slipped above the minor trendline resistance but whipsawed to the downside and now back below the trendline resistance indicating potential further bearish pressure as we may have a false breakout scenario here. However we know that 85.30/00 region is a strong support area and need to be clearly broken before testing 84.82 and 83.35 region. Immediate resistance at 85.96 followed by 86.25 area.

Posted by T.Jagat at 12:02 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

GBP/USD Daily Forecast

The GBPUSD attempted to push lower yesterday, bottomed at 1.5709 closed higher at 1.5850 but traded lower around 1.5790 at the time I wrote this comment. The bias is neutral in nearest term and overall we are still in bullish phase as long as price move inside the bullish channel but further downside pressure still potential from here re-testing 1.5735/09 support area. Consistent move below that area could trigger further bearish pressure testing 1.5660 even 1.5550 region. Bullish may re-gain its momentum again only if able to stay consistently above 1.5966.

Posted by T.Jagat at 12:02 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY made a significant bearish momentum by slipped below the bullish channel as you can see on my h4 chart below indicating a serious threat to the upside correction scenario. The bias is bearish in nearest term testing 110.70. Immediate resistance at 112.70. Break above that area should keep the upside scenario intact.

GBPJPY Daily Forecast

The GBPJPY continued its bearish momentum yesterday and keep moving lower earlier today in Asian session traded around 134.60 at the time I wrote this comment. The bias is bearish in nearest term testing 113.70. Immediate resistance at 135.80. Break above that area could lead us into neutral zone but the bearish scenario remains intact as long as price move inside the bearish channel.

AUDUSD Forecast

The AUDUSD attempted to push lower yesterday, bottomed at 0.9058 but closed higher at 0.9131 and traded lower again around 0.9070 at the time I wrote this comment. After price break below the rising wedge, technically we are enter the bearish phase at least in nearest term now testing 0.9040 area. Break below that area could trigger further bearish pressure targeting 0.8965 before testing key support level around 0.8858. Immediate resistance at 0.9139 (current high). Break above that area could lead us into neutral zone.

Posted by T.Jagat at 11:59 AM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

EUR/USD Daily Forecast

The EURUSD attempted to push lower yesterday, bottomed at 1.3074, closed higher at 1.3175 and now traded lower again 1.3105 at the time I wrote this comment. Overall we are still in bullish phase but if there are times when price will make potential significant downside correction, now is one of those times. Like I said, we are now in a tricky phase. The bias is neutral in nearest term but further downside pullback still potential from here testing 1.3045/00 region especially if price able to move consistently below 1.3105. Bullish may re-gain its momentum again only if able to stay consistently above 1.3250.

Posted by T.Jagat at 11:58 AM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

USD/CHF Daily Forecast

The USDCHF failed to continue its bearish scenario yesterday after unable to re-test 1.0350 support area, topped at 1.0498 and slipped above 1.0500 at the time I wrote this comment. The bias is bullish in nearest term testing 1.0580 even 1.0675 area but only a consistent move above 1.0675 could be seen as a serious threat to the bearish outlook. On the downside, we need a clear break below 1.0350 to continue the bearish scenario.

Posted by T.Jagat at 1:51 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

USD/JPY Daily Forecast

The USDJPY attempted to push higher yesterday, but as you can see on my h4 chart below the minor trendline resistance did a good job so far. The bias remains neutral and we may have another upside pressure re-testing the minor trendline resistance but overall the major scenario remains bearish. Consistent move above the minor trendline resistance and 85.96 area could trigger further upside correction testing 86.50 - 87.00 area. On the downside, 85.32 and 84.82 remains the nearest bearish target before testing 83.35 region.

Posted by T.Jagat at 1:50 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

GBP/USD Daily Forecast

The GBPUSD had a bearish momentum yesterday after unable to move consistently above 1.5966, bottomed at 1.5892 and keep moving lower around 1.5820 at the time I wrote this comment. The bias is bearish in nearest term especially if price able to move consistently below 1.5815 area targeting 1.5735. We are entering the tricky phase here as we have conflicting bias between short term (bearish) and medium term (bullish). Fundamental focus will be on FOMC statement.

Posted by T.Jagat at 1:49 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY attempted to push higher yesterday, but so far unable to consistently move above the minor trendline resistance and traded lower around 113.16 at the time I wrote this comment. The bias is bearish in nearest term testing 112.70 but the bullish correction scenario remains intact as long as the bullish channel hold. Break below 112.70 could trigger further downside pressure testing the lower line of the bullish channel and 112.00 - 111.50 region which could be a serious threat to the bullish correction scenario. Immediate resistance at 113.73 (current high). Consistent move above that area could resume the upside correction scenario testing 114.73 and 115.50.

GBPJPY Daily Forecast

The GBPJPY was indecisive yesterday, but traded lower around 135.90 at the time I write this comment. On h1 chart below we can see the upper line of the bearish channel did a good job preventing upside pressure indicating potential further downside momentum testing 134.96/50 area. On the upside, only a violation to the bearish channel and movement above 137.00 could continue the upside correction scenario re-testing 137.50/70.

AUDUSD Forecast

The AUDUSD made a significant technical movement today, by break below the rising wedge formation. This fact could trigger further bearish pressure at least testing 0.9040 region. Immediate resistance remains at 0.9220/30 and only break above that area could continue the bullish scenario.

Posted by T.Jagat at 1:48 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

EUR/USD Daily Forecast

The EURUSD failed to continue its bullish scenario yesterday after unable to re-test 1.3340 resistance level, bottomed at 1.3215 and keep moving lower around 1.3190 at the time I wrote this comment. The bias is bearish in nearest term testing 1.3105 area but note that we are still in bullish phase. Immediate resistance at 1.3250. Another move above that area could trigger further upside pressure testing 1.3340. We are entering the tricky phase here as we have conflicting bias between short term (bearish) and medium term (bullish). Fundamental focus will be on the FOMC statement.

Posted by T.Jagat at 1:47 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

USD/CHF Daily Forecast

The USDCHF made another indecisive movement yesterday. We have unclear direction in nearest term as price is now consolidating but the main scenario remains bearish with nearest target remains around 1.0320 and 1.0220 area. Immediate resistance remain around 1.0500 region.

Posted by T.Jagat at 1:13 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

USD/JPY Daily Forecast

The USDJPY continued its bearish momentum yesterday, bottomed at 85.67 and closed hit 85.39 earlier today in Asian session. The bias is bearish in nearest term targeting 84.82 (November 2009 low). Immediate resistance at 85.96 and the minor trendline resistance (blue). Break above that area could lead us into neutral zone in nearest term but the main scenario remains bearish and I still prefer short on rallies strategy.

Posted by T.Jagat at 1:12 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

GBP/USD Daily Forecast

The GBPUSD also had a moderate bullish momentum yesterday, topped at 1.5966 and closed at 1.5950. The bias remains bullish in nearest term especially if price break above 1.5966 targeting 1.6000/50 before testing 1.6150. We are going to have the NFP on Friday and usually market could become a little bit more unpredictable especially in nearest term. Immediate support at 1.5850/15 region. Note that price has been moving in strong bullish momentum without significant correction since July 22 so any downside pullback should not be a surprise.

Posted by T.Jagat at 1:11 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY failed to continue its bullish momentum yesterday and now back below 113.50. The bias is neutral in nearest term as direction is unclear but as long as price move inside the bullish channel the upside correction scenario remains intact. Immediate support at 112.70. Break below that area could trigger further downside pressure testing 111.50 and the lower line of the bullish channel. Initial resistance at 113.70/50 followed by 114.10/15 area.

GBPJPY Daily Forecast

The GBPJPY failed to continue its bullish momentum yesterday and slipped below 136.30 support area earlier today in Asian session. The bias is bearish in nearest term especially if price able to move consistently below 136.30 and violate the bullish channel testing 134.90 support area. Initial resistance at 137.36 (yesterday's high). Break above that area could continue the upside correction scenario testing 139.50 this week.

AUDUSD Forecast

The AUDUSD was indecisive yesterday. The bias is neutral in nearest term. The main scenario remains bullish but as long as the rising wedge exist, I will stand aside from this pair. Immediate support at 0.9070. Initial resistance, which is also the nearest technical bullish target at 0.9230 area.

Posted by T.Jagat at 1:10 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ, UJ, USDJPY

EUR/USD Daily Forecast

The EURUSD had a moderate bullish momentum yesterday, topped at 1.3260 and closed a little bit lower at 1.3229. On daily chart below we have another bullish technical evidence where price break above the trendline resistance. The bias is neutral in nearest term but overall we are still in strong bullish phase. We are going to have the NFP on Friday and usually market could become a little bit more unpredictable especially in nearest term. Immediate support at 1.3200 followed by 1.3150. On the upside, a break above 1.3260 could trigger further upside pressure testing 1.3340.

Posted by T.Jagat at 1:08 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

EUR/USD Daily Forecast

The EURUSD made another indecisive movement yesterday, formed another Doji on daily chart. Price still unable to consistently move above 1.3000 and we know that it is a very strong resistance, which could produce bullish exhaustion and downside consolidation unless price able to break above 1.3045 area, targeting 1.3120 before testing 1.3270 - 1.3340 region. The bias remains neutral in nearest term but overall we are still in bullish phase. Immediate support at 1.2900 - 1.2880 area. Break below that area could trigger further bearish momentum testing 1.2735 key support area.

Posted by T.Jagat at 12:31 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY failed to continue its bullish momentum yesterday and slipped below 113.50 indicating potential bullish failure and a false breakout scenario. I will stand aside from this phase for now. Immediate support at 112.70/60 region. Break below that area could trigger further downside pressure testing 111.60/50 area. On the upside, 115.50 and 117.00 remains the nearest bullish targets.

GBPJPY Daily Forecast

The GBPJPY attempted to push higher yesterday, topped at 137.55 but closed lower at 136.18. On h1 chart below we have a descending triangle formation indicating potential bearish in nearest term especially if price breakdown below the triangle targeting 135.50/15 region. On the other hand, breakout above the triangle could trigger further upside momentum re-testing 137.55 as bearish scenario fails.

AUDUSD Forecast

The AUDUSD had a bearish momentum yesterday. The rising wedge formation bearish warning is now become more real, threat the bullish scenario especially if price able to move consistently below the formation and 0.8858 key support area at least testing 0.8770. Immediate resistance at 0.8980 area. Break above that area could trigger further upside pressure testing 0.9025/70 region.

Posted by T.Jagat at 12:31 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD was indecisive yesterday, made a Doji on Daily chart, pause the bullish momentum. The bias is neutral in nearest term. Immediate support at 1.5470. Break below that area could trigger further downside pullback but as long as price move inside the bullish channel wee area still in strong bullish phase. On the upside potential bullish targets remains at 1.5685 and 1.5815 region.

Posted by T.Jagat at 12:29 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY failed to continue its bullish correction yesterday. On h1 chart below we can see that price is now testing the trendline support indicating critical phase. Break below the trendline support could trigger further bearish pressure testing 86.82/33 region and could potentially end the upside correction. Immediate resistance at 88.23/11 area.

Posted by T.Jagat at 12:28 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF failed to continue its bullish correction yesterday but still able to move above 1.0560/40 support area so far. The bias is neutral in nearest term. Consistent move below 1.0560/40 and a break below the trendline support (red) could end the upside correction testing 1.0500 - 1.0480 before targeting 1.0399 key support area. On the upside, 1.0675 - 1.0750 remains the bullish correction nearest targets.

Posted by T.Jagat at 12:28 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD attempted to push higher yesterday, topped at 1.3045 but again, failed to consistently move above 1.3000 so far. The bias is neutral in nearest term but I believe we are still in strong upside phase unless price break below 1.2735 region. Immediate support at 1.2950 followed by 1.2880. On the upside, 1.3120 remains the nearest bullish target.

Posted by T.Jagat at 12:02 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY finally broke above the range area of 113.50 - 108.07 , topped at 114.41 and closed at 114.21. This fact change my medium mode into bullish outlook testing 115.50 before targeting 117.00 region. Another downside pullback below 113.50 would lead us into neutral and no trade zone but overall we are still in upside correction phase which begin from 107.50.

GBPJPY Daily Forecast

The GBPJPY also made a breakout from the range area yesterday, topped at 137.21 and closed at 136.99. The bias is bullish in nearest term testing 138.18 - 139.38 before targeting 140.56 region. On the downside, immediate support at 136.30 (former resistance). Break below that area could lead us into neutral and no trade zone testing 135.30.

AUDUSD Forecast

The AUDUSD failed to continue its bullish momentum yesterday. Like I said, although the main scenario remains bullish, the bearish warning indicated by the rising wedge can not be ignored especially if price break below 0.8858 area testing 0.8740 even 0.8630 region. Immediate resistance at 0.9070. Break above that area could continue the bullish scenario testing 0.9140 and 0.9380 area. I will stay away from this pair for now.

Posted by T.Jagat at 11:59 AM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD continued its bullish momentum yesterday, topped at 1.5600 and closed at 1.5594. The bias remains bullish in nearest term targeting 1.5685. Break above that area could trigger further upside pressure testing 1.5815. Immediate support at 1.5470 (former resistance). Break below that area could lead us into neutral zone but overall we are still in upside phase.

Posted by T.Jagat at 11:56 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY had a significant bullish momentum yesterday, break above my minor trendline resistance as you can see on my h1 chart below. The bias is bullish in nearest term targeting 88.23 area before testing 89.10. However note that the major scenario remains to the downside. Immediate support at 87.30 region. Break below that area could trigger further bearish pressure testing 86.82.

Posted by T.Jagat at 11:37 AM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF finally broke above the range area, topped at 1.0640 and closed at 1.0599. This bias is bullish in nearest term testing 1.0675 and 1.0750 area but note that the major trend remains bearish. Immediate support at 1.0560/40 region. Break below that area could lead us into neutral zone in nearest term testing 1.0500 area.

Posted by T.Jagat at 11:36 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD touched 1.3000 area yesterday but still unable to move consistently above that psychological/key level so far. On h4 chart below we can see that we may have a triple top formation around 1.3000. Consistent move above 1.3000 could trigger further bullish pressure testing 1.3120 even higher. On the other hand, break below 1.2735 confirms the triple top scenario and could be a serious threat to the current bullish outlook. Immediate support at 1.2950 (23.6% Fibo retracement of 1.2793 - 1.3005). Break below that area could trigger further bearish pullback testing 1.2875 (61.5% Fibo retracement of 1.2793 - 1.3005).

Posted by T.Jagat at 11:23 AM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY was indecisive yesterday. Price so far unable to stay consistently above 113.50 area indicating limited upside pressure. Overall price still trapped in range area of 113.50 - 108.07. We need a consistent move above 113.50 to continue the bullish correction testing 115.50. Immediate support at 112.25 followed by 111.50/60 region.

GBPJPY Daily Forecast

The GBPJPY attempted to push higher yesterday, topped at 135.60 but closed lower at 134.64. Overall we are still in range area of 136.30 - 130.50 and I will keep stay away from this pair for now. On h1 chart below we have a descending triangle formation indicating potential downside pressure especially if price break below the triangle testing 133.70/20 support area. On the upside, we need a clear break above 136.30 resistance area to confirm the bullish scenario testing 139.38 region.

AUDUSD Forecast

The AUDUSD had a moderate bullish momentum yesterday. The main scenario remains bullish but the rising wedge bearish scenario warning is still there and we need price to violate the formation with strong momentum to continue the bullish scenario targeting 0.9140 before testing 0.9380 in longer term. On the downside, only a break below 0.8858 and the rising wedge formation could be considered as potential bullish failure.

Posted by T.Jagat at 11:23 AM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD slipped above 1.5470 resistance area indicating potential further upside pressure at least targeting 1.5573 (February 23 high) before testing 1.5685 region (February 18 high). Another move below 1.5470 could lead us into neutral zone in nearest term testing 1.5400 but overall we are still in strong bullish phase and I prefer buy the dips strategy at this phase.

Posted by T.Jagat at 11:21 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY failed to continue its bullish correction yesterday and now back below 87.00. My short term technical study is a a little bit mess for this pair but overall the major scenario remains to the downside with nearest bearish target around 86.25 - 85.86 before re-testing 84.80 area. Immediate resistance at 87.50 followed by 88.23.

Posted by T.Jagat at 11:20 AM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

USDCHF is moving inside a rectangle area indicating consolidation after significant bearish momentum. We need a break from the range area to see clearer direction. Break above 1.0560 could trigger further bullish pullback testing 1.0650/70 while a break below 1.0399 could continue the major bearish scenario targeting 1.0320 and 1.0220 region.

Posted by T.Jagat at 11:19 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD was indecisive on Friday. Price attempted to push lower, bottomed at 1.2794 but closed higher at 1.2914. On h4 chart below we can see that price is moving inside a triangle formation after failed to consistently move above 1.3000 and found support around 1.2735 indicating consolidation. Breakout above the triangle could trigger further upside pressure re-testing 1.3000 before targeting 1.3120. On the other hand, breakdown below the triangle could trigger further bearish pressure testing 1.2735 region. Overall we are still in bullish phase.

Posted by T.Jagat at 11:26 AM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY continued its upside pressure on Friday. On daily chart below we can see price is now testing 113.50 key resistance which is the upper line of my range area. A consistent move above that area could trigger further upside pressure targeting 115.50 before testing 117.00. Immediate support at 112.50. Break below that area could trigger further downside pressure and lead us back into range and no trading zone.

GBPJPY Daily Forecast

The GBPJPY had a significant bullish momentum on Friday after breakout above my minor trendline resistance as you can see on my h4 chart below. The bias is bullish in nearest term testing 136.30 but note that overall we are still consolidating between 136.30 - 130.50. We need a clear break above 136.30 to take us into a new bullish phase at least testing 139.38 area. Immediate support at 134.50/00 region.

AUDUSD Forecast

The AUDUSD had a limited bullish momentum on Friday. The bias is neutral in nearest term but overall we are still in strong bullish phase targeting 0.9076. The tricky thing is that we have a rising wedge formation which is a bearish formation especially if price break below the formation and 0.8858 support area.

Posted by T.Jagat at 11:17 AM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD continue its bullish momentum on Friday, topped at 1.5448 and closed at 1.5420. The bias is bullish in nearest term especially if price able to move consistently above 1.5470 area targeting 1.5573 (February 23 high) before testing 1.5685 region (February 18 high). Immediate support at 1.5400 - 1.5380. Break below that area could lead us into no trading zone in nearest term testing 1.5280/50 support area.

Posted by T.Jagat at 11:14 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY had a significant bullish pullback on Friday, break above the minor bearish channel indicating potential further upside pullback in nearest term testing 88.23. Consistent move above that area could trigger further upside recovery testing 89.10. On the downside, immediate support at 87.00. Break below that area could trigger further bearish pressure testing 85.86 area. Overall we are still in major bearish scenario.

Posted by T.Jagat at 11:13 AM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF had a bullish momentum on Friday, topped at 1.0562 and closed at 1.0534. The bearish pressure seems to losing some momentum as price is ready to test the major bearish channel. Violation to the bearish channel could be a serious treat to the major bearish outlook. Immediate resistance at 1.0650/70. Break above that area could trigger further upside pressure testing 1.0750. Initial support at 1.0399. Break below that area should keep the major bearish scenario intact testing 1.0320 and 1.0220 region.

Posted by T.Jagat at 11:12 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Weekly Summary

The EURUSD was indecisive this week, formed a Doji on weekly chart. We are still in an upside correction phase and price consolidating lower, making a new minor bearish channel after unable to move consistently above 1.3000 psychological level. We need a consistent move above that area to continue the bullish scenario testing 1.3120 (38.2 Fibo retracement of 1.5140 - 1.1876). Break above that area could trigger further upside momentum testing 1.3341 (April 30 high). Immediate support at 1.2735 area. Break below that area could trigger further bearish pressure testing 1.2530 but as long as price is moving inside the bullish channel the upside scenario should remain intact.

Posted by T.Jagat at 2:22 PM 0 comments

Labels: currency exchange, EU, EURUSD, forex, weekly summary

EUR/USD Daily Forecast

The EURUSD had a significant bearish momentum, slipped below the minor trendline support, indicating potential bearish view in nearest term testing 1.2670 - 1.2600 region. However note that overall we are still in upside correction phase and only a movement below the major bullish channel and 1.2465 support area could be considered as potential bullish failure. I will keep stand aside for now. Immediate resistance at 1.2800. Consistent move above that area could trigger further upside pressure testing 1.2880 - 1.2900 area.

Posted by T.Jagat at 1:15 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY had a significant bearish momentum, slipped below the bullish channel and 110.85 support area indicating potential bearish view not only targeting 119.15 in nearest term but potentially resume the major bearish scenario as upside correction may over now. Another movement above 110.85 could lead us into neutral zone as direction is unclear testing 111.50 area.

GBPJPY Daily Forecast

The GBPJPY had a significant bearish momentum yesterday, bottomed at 131.57 and closed at 131.96 and traded around 131.58 at the time I wrote this comment. The bias is bearish in nearest term testing 131.25 and 130.50 region but unless we have a break from the range area I will keep out from the market. Immediate resistance at 132.20/30. Consistent move above that area could trigger further upside pressure testing 133.00/10.

AUDUSD Forecast

The AUDUSD failed to break above 0.8858 yesterday. The bias is neutral in nearest term. The major scenario remains to the upside but again, we need a clear break above 0.8858 area to continue the bullish scenario testing 0.8980 - 0.9000. Below 0.8858, we still have potential volatility and downside consolidation inside the circled area. Immediate support at 0.8660/80 region.

Posted by T.Jagat at 1:11 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD had a significant bearish momentum yesterday, bottomed at 1.5123 but fail to stay consistently above 1.5150 so far. The lower line of the bullish channel did a good job preventing further bearish attack which keep the bullish outlook intact but clearly the upside scenario is under serious attack now. Violation to the bullish channel could be seen as bullish failure testing 1.5050 - 1.5000 support area. Immediate resistance at 1.5215 region. Consistent move above that area could trigger further upside pressure testing 1.5350 .

Posted by T.Jagat at 1:09 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY failed to continue its bullish correction yesterday and now back below 87.00. The bias is bearish in nearest term testing 85.86 before targeting 84.82 area in long term. On the upside, another movement above 87.00 could lead us into no trading zone in nearest term as direction is unclear testing 87.50 - 88.23 resistance area but overall the major scenario remains to the downside.

Posted by T.Jagat at 1:08 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF didn't make significant movement yesterday. The bias remains neutral but still within a major bearish scenario. Nearest support to be tested at 1.0399. Break below that area could trigger further bearish momentum targeting 1.0320 before testing 1.0220 region. On the upside, immediate resistance at 1.0600 region. Break above that area and violation to the major bearish channel could be a serious threat to the bearish outlook testing 1.0750 area.

Posted by T.Jagat at 1:08 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD was volatile but showed unclear direction yesterday. On h1 chart below we can see price is forming a broadening formation where price makes new highs and lows without clear direction. The upside scenario remains intact but the appearance of the broadening formation activates my wait and see mode. Note that price also reject to move consistently above 1.3000 since Friday, which may indicate potential bullish exhaustion. Immediate resistance at 1.2920 area. Consistent move above that area could trigger further upside pressure towards 1.3000 region again before testing 1.3120. Initial support at 1.2750.

Posted by T.Jagat at 2:35 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY still trapped in range area of 113.50 - 110.85 in a volatile but unclear movement. I think I will keep stand aside for now and need a break on either side to see clearer direction. Break above 113.50 could trigger further bullish pressure testing 115.50 area while break below 110.85 could end the bullish correction at least testing 109.00 region. Aggressive traders may short around 113.50 or long around 110.85 with tight stop loss.

GBPJPY Daily Forecast

The GBPJPY had a bullish momentum yesterday, topped at 133.74 and closed at 133.52. The bias is bullish in nearest term testing 134.50 area. However, we have a broadening formation inside the range area (0f 136.30 - 130.50) which is actually confirm unclear direction and should keep us out from the market for now.

AUDUSD Forecast

The AUDUSD had a bullish momentum yesterday and now seems ready to test 0.8858 key resistance area. Consistent move above that area confirms the bullish continuation scenario at least testing 0.8980 - 0.9000 area. Immediate support at 0.8790. Break below that area could lead us into neutral zone in nearest term testing 0.8730 but the main scenario remains to the upside.

Posted by T.Jagat at 2:33 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD attempted to push lower yesterday, bottomed at 1.5153 but closed higher at 1.5260. This fact keeps the bullish outlook intact testing 1.5350 in nearest term but need a clear break above 1.5470 to confirm bullish continuation scenario in longer term. On the downside, the lower line of the bullish channel and 1.5150 area is the key support area. A break below that area could be a serious threat to the bullish outlook.

Posted by T.Jagat at 2:31 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/CHF Daily Forecast

The USDCHF attempted to push lower yesterday, bottomed at 1.0452 but closed higher at 1.0524. On h1 chart below we can see price is moving inside a new minor bullish channel indicating upside correction phase but the major bearish scenario remains intact as long as price move inside the major bearish channel. Immediate resistance at 1.0630. Consistent move above that area and violation to the major bearish channel could be a serious threat to the bearish scenario testing 1.0750. On the downside we need a break below 1.0399 to continue the bearish scenario testing 1.0220.

Posted by T.Jagat at 2:27 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD didn't make significant movement yesterday. The bullish momentum so far unable to make a break above 1.3000 resistance area but the bullish phase remains intact. The bias remains neutral in nearest term. As you can see on my h4 chart below we have a flag formation indicating potential bullish scenario especially if price break above the flag and 1.3000 area targeting 1.3120. Immediate support at 1.2900. Consistent move below that area could trigger further bearish pressure testing 1.2750 region.

Posted by T.Jagat at 1:15 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY was volatile but indecisive yesterday. I have made adjustment to my bullish channel following newest development. Price seems to be trapped in range area of 113.50 - 110.85 and need a break on either side to see clearer direction but the bullish correction scenario remains intact. Break above 113.50 could trigger further bullish pressure testing 115.50 area while break below 110.85 could end the bullish correction at least testing 109.00 region. I think I will stand aside from this pair from now and see further development.

GBPJPY Daily Forecast

The GBPJPY was volatile but indecisive yesterday and still trapped in the range area 136.30 - 130.50. This volatile yet unclear movement is something that should watch, but not trade. I will keep stay away from this pair. Aggressive traders may long around 130.50 or short around 136.30 with tight stop loss.

AUDUSD Forecast

The AUDUSD was indecisive yesterday but had a bullish momentum earlier today in Asian session, hit 0.8775. The bias is bullish in nearest term testing 0.8858 but we need a consistent move above the ascending triangle and 0.8858 to continue the major bullish outlook. Note that as long as price stay below 0.8858 we still have potential downside consolidation inside the circled area. Immediate support at 0.8665 (current low).

Posted by T.Jagat at 1:12 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD continued its bearish pressure yesterday, bottomed at 1.5202 and closed at 1.5227 after failed to move above 1.5470 but the bullish scenario remains intact as long as price move inside the bullish channel. On daily chart below we can see that price seems ready to test the lower line of the bullish channel and 1.5150 key support area. Break below that area could be a serious threat to the bullish outlook testing 1.5050 - 1.5000. On the upside, we need a consistent move above 1.5350 to continue the bullish scenario.

Posted by T.Jagat at 1:10 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY slipped above 87.00 yesterday but closed lower at 86.69 and now struggling around 87.00. The bias remains neutral in nearest term but the main scenario remains bearish. Immediate resistance at 87.20 (yesterday's high). Consistent move above that area could trigger further upside pressure testing 88.00. On the downside, 85.86 area remains potential nearest bearish target before testing 84.82.

Posted by T.Jagat at 1:09 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF continued its bullish correction yesterday. Price seems ready to the bearish channel but as long as the channel hold the main scenario remains to the downside. Immediate resistance at 1.0675. Break above that area could be a serious threat to the bearish outlook. Initial support at 1.0480. Break below that area could trigger further downside pressure re-testing 1.0400.

Posted by T.Jagat at 1:08 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Daily Forecast

The EURUSD attempted to push higher on Friday but found good resistance around 1.3000 psychological/key level, closed lower at 1.2926 and hit 1.2882 earlier today in Asian session. The bias is neutral in nearest term but overall we are still in upside correction phase. Immediate resistance at 1.2950 area. Consistent move above that area could trigger further upside momentum re-testing 1.3000 before testing 1.3120 region. On the downside, initial support at 1.2840. Break below that area could trigger further bearish pressure testing 1.2750.

Posted by T.Jagat at 12:07 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY had a significant bearish momentum on Friday, slipped below the bullish channel as you can see on my h4 chart below indicating potential bullish failure testing 110.85 in nearest term. On the upside, another movement inside the bullish channel and consistent move above 112.30 resistance area could produce a false breakdown scenario which could potentially trigger another upside momentum testing 113.50 area.

GBPJPY Daily Forecast

The GBPJPY also had a significant bearish momentum on Friday, break below the minor bullish channel indicating potential downside pressure testing 131.25 and 130.50. However note that overall price still trapped in range area of 136.30 - 130.50 so I will keep stay out for now. Immediate resistance at 133.05 area. Consistent move above that area could trigger further upside pressure testing 134.00/20 region.

AUDUSD Forecast

The AUDUSD had a bearish momentum on Friday, bottomed at 0.8681 and closed at 0.8695 and hit 0.8631 earlier today in Asian session. I think this is a normal downside correction as long as price still move inside the ascending triangle which indicating major bullish scenario. We may have further downside consolidation inside circled area but only violation to the downside of the ascending triangle could cancel the bullish scenario after made a triple bottom formation around 0.8070 area. Immediate resistance at 0.8710/20 region. Break above that area could trigger further upside pressure testing 0.8780 before re-testing 0.8858.

Posted by T.Jagat at 12:06 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD failed to continued its bullish momentum on Friday, bottomed at 1.5278 and closed at 1.5298. The bias is neutral in nearest term but overall we are still in bullish phase. On h1 chart below we can see that price found a good support at 38.2% Fibo retracement of 1.4964 - 1.5470 around 1.5280 area. Break below that area could trigger further bearish pressure testing 1.5150 region and could be a serious threat to the bullish outlook. Immediate resistance at 1.5340. Consistent move above that area could trigger further upside momentum re-testing 1.5470 and keep the bullish scenario remains strong.

Posted by T.Jagat at 11:47 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY continued its bearish momentum on Friday, bottomed at 86.25 but closed higher at 86.66. The bias is neutral in nearest term but still within a major bearish scenario. Immediate resistance at 87.00. Break above that area could lead us into neutral zone in nearest term testing 87.50 - 88.00 area. On the downside, 85.86 area remains potential nearest bearish target before testing 84.82.

Posted by T.Jagat at 11:46 AM 0 comments

Labels: currency exchange, daily forecast, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF failed to continue its bearish momentum on Friday, topped at 1.0541 and closed at 1.0515. This fact activates my wait and see mode for now but overall we are still in major bearish scenario. Immediate support at 1.0450. Break below that area could trigger further bearish pressure testing 1.0400 and 1.0320. On the upside, another movement above 1.0500 could trigger further upside pressure testing 1.0600 region.

Posted by T.Jagat at 11:27 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

EUR/USD Weekly Summary

The EURUSD continued its bullish momentum this week, topped at 1.3006 but closed lower at 1.2926. We are still in strong bullish phase and should pay attention to 1.3000 key resistance area. Consistent move above that psychological level could trigger further bullish momentum testing the trendline resistance (red) and 1.3120 area (38.2 Fibo retracement of 1.5140 - 1.1876) before testing 1.3354 (May open/high). Immediate support at 1.2750 (23.6% Fibo retracement of 1.1876 - 1.3006). Break below that area could trigger further bearish pressure testing 1.2520 - 1.2465 support area.

Posted by T.Jagat at 11:20 AM 0 comments

Labels: currency exchange, EU, EURUSD, forex, weekly summary

EUR/USD Daily Forecast

The EURUSD didn't make significant movement yesterday. The bias is neutral in nearest term but we are still in upside correction scenario testing 1.2850 - 1.2900 area. Immediate support at 1.2650. Break below that area could trigger further bearish pressure testing the minor trendline support (red) and 1.2550 area but as long as price move inside the bullish channel we are still in upside correction phase.

Source

Posted by T.Jagat at 12:23 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY was indecisive yesterday, made a Doji on daily chart. The bias is neutral in nearest term but we are still in upside correction phase as long as price move inside the bullish channel with 113.50 remains the nearest target before testing 115.50 area. Immediate support at 111.50 and the lower line of the bullish channel. Break below that area could be a serious threat to the upside scenario.

GBPJPY Daily Forecast

The GBPJPY attempted to push higher yesterday, topped at 135.79 but closed lower at 134.90. The bias remains neutral medium term but potentially remains to the upside in nearest term as price is now moving inside a minor bullish channel as you can see on h4 chart below testing 136.30 key resistance area. Immediate support at 134.10 followed by 133.15 area. Break below 133.15 could trigger further bearish pressure testing 130.50 region.

AUDUSD Forecast

The AUDUSD slipped above 0.8858 yesterday but still unable to move consistently above that area. The bias remains bullish in nearest term but we need a consistent move above 0.8858 to continue the bullish scenario testing 0.8970 and 0.9025 area. Immediate support at 0.8700 - 0.8660 area.

Source

Posted by T.Jagat at 12:21 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

GBP/USD Daily Forecast

The GBPUSD continued its bullish momentum yesterday, topped at 1.5295 and closed at 1.5264. The bias remains bullish in nearest term testing 1.5400 region. However CCI about to cross the 100 line down on h4 chart so watch out for potential downside pullback testing 1.5200 - 1.5150 support area. Overall we are still in strong upside correction phase after the failure to consistently move below 1.5000 support area and only a movement back below 1.5000 could diminish the upside scenario.

Source

Posted by T.Jagat at 11:41 AM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

USD/JPY Daily Forecast

The USDJPY attempted to push lower yesterday, but still unable to break below 88.00 area. The bias remains neutral in nearest term. The major trend remains bearish but need a consistent move below 88.00 to continue the bearish pressure at least testing 87.00. On the upside, we need a clear break above 89.15/50 area to continue bullish correction testing 90.50.

Source

Posted by T.Jagat at 11:25 AM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

USD/CHF Daily Forecast

The USDCHF attempted to push higher yesterday, topped at 1.0617 but whipsawed to the downside and closed lower at 1.0524. This fact could trigger further bearish pressure testing 1.0500 - 1.0480 support area today. Break below that area could resume the major bearish scenario targeting 1.0400 and 1.0220 region. Immediate resistance at 1.0550 followed by 1.0617.

Source

Posted by T.Jagat at 11:23 AM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

USD/CHF Daily Forecast

The USDCHF had a moderate bearish momentum yesterday, bottomed at 1.0512 and closed at 1.0545. The bias is neutral in nearest term. The main scenario remains to the downside but as long as price stay above 1.0500 - 1.0480 area the upside correction scenario remains intact. Immediate resistance at 1.0585. Consistent move above that area could trigger further bullish pressure towards 1.0650 before testing 1.0750. On the downside, break below 1.0480 could end the upside correction targeting 1.0400 and 1.0220 region.

Source

Posted by T.Jagat at 1:15 PM 0 comments

Labels: currency exchange, daily forecast, forex, UCHF, USDCHF

USD/JPY Daily Forecast

The USDJPY slipped below 88.23 yesterday, but whipsawed to the upside and closed higher at 88.71. This fact should keep the bullish correction scenario intact with nearest target remains at 89.50 and 90.50 but note that the major trend remains bearish. On the downside, we need a consistent move below 88.23/00 region to cancel this bullish scenario targeting 87.00.

Source

Posted by T.Jagat at 1:12 PM 0 comments

Labels: currency exchange, daily forecast, forex, UJ, USDJPY

GBP/USD Daily Forecast

The GBPUSD had a significant bullish momentum yesterday after good UK CPI and bad US trade balance data, topped at 1.5191 and keep moving higher around 1.5210 at the time I wrote this comment. The bias is bullish in nearest term especially if price able to move consistently above 1.5238 targeting 1.5400 - 1.5500 region. Immediate support at 1.5100 - 1.5080. Break below that area would lead us into neutral zone as direction is unclear testing 1.5000 - 1.4950 support area.

Source

Posted by T.Jagat at 1:08 PM 0 comments

Labels: currency exchange, daily forecast, forex, GBPUSD, GU

Daily Forecast for Crosses

EURJPY Daily Forecast

The EURJPY attempted to push lower yesterday, slipped below the bullish channel and 110.85 support area but whipsawed to the upside, break above the minor bearish channel, topped at 112.92 and closed at 112.87. The bias is bullish in nearest term targeting 113.50 and 114.40 area. Immediate support at 112.20. Break below that area could lead us into no trading zone but overall we are still in upside correction phase as long as price move inside the bullish channel.

GBPJPY Daily Forecast

The GBPJPY was bullish yesterday after break above 134.00 and keep moving higher around 135.10 at the time I wrote this comment earlier today in Asian session. The bias is bullish in nearest term testing 136.30 region but overall price still trapped in range area. Immediate support at 134.00. Break below that area could lead us into neutral zone both in nearest and medium outlook.

AUDUSD Forecast

The AUDUSD attempted to push lower yesterday, bottomed at 0.8682 but whipsawed to the upside, closed at 0.8829. The bias is bullish in nearest term testing 0.8858 resistance area. We need a consistent move above that area to continue the bullish scenario testing 0.8970 - 0.9025 area. Immediate support at 0.8790/60. Break below that area could lead us into neutral zone in nearest term but the main scenario remains to the upside.

Source

Posted by T.Jagat at 1:05 PM 0 comments

Labels: AU, AUDUSD, currency exchange, daily forecast, EJ, EURJPY, forex, GBPJPY, GJ

EUR/USD Daily Forecast

The EURUSD had a significant bullish momentum yesterday after bad US trade balance number, topped at 1.2737 and closed at 1.2722. The rising wedge formation has failed indicating potential technical bullishness targeting 1.2850 - 1.2900 area. Immediate support at 1.2650 (former resistance). Break below that area would lead us into neutral zone. Although technical study is bullish, I think this bullish run is tricky and fragile from fundamental point of view since yesterday we had bad Euro zone ZEW economic sentiment number, keep the Euro zone in negative territory.

Source

Posted by T.Jagat at 12:56 PM 0 comments

Labels: currency exchange, daily forecast, EU, EURUSD, forex

NEWS : Instant warm-up: InstaForex Award

Posted by T.Jagat at 3:30 PM 0 comments

Labels: broker, instaforex, news

BANK RAKYAT : PAWN BROKING-i AR-RAHNU

This scheme provides a source of immediate financing to assist individuals in overcoming cash-flow needs. | |||||||||

| Concept Al-Wadiah and Qardhul Hassan | |||||||||

Eligibility

| |||||||||

Quantum of Financing

| |||||||||

Repayment Period

| |||||||||

| Pawn Products Gold jewellery 18K - 24K | |||||||||

| Fees A minimum fee is charged for the safekeeping of the valuables. | |||||||||

|

Posted by T.Jagat at 4:19 PM 0 comments

Labels: Ar Rahnu, bank rakyat

AGROBANK : Ar Rahnu Scheme

Terms & Conditions

- Open to all individual or non-individual who is Malaysian citizens.

- Aged 18 years old and above

- Maximum RM 50,000 ( RM 10,000 per day )

- Minimum RM 100

- 6+3+2 months (The period for the first service is for 6 months, and can be extended to 3 months more and another final extension for 2 months more)

- All types of jewelleries made in gold, such as: rings, hand and legs bracelets, brooches or others.

- Pound Gold and White Gold are not accepted.

Redeeming Pawned / Kept Items

- Redemption can be made in stages or at once or anytime before or after the deadline.

- depends on the latest amendment of the bank policies

- Financing through Syariah law

- Fast, Easy and Secure. Kept items are ensured of its safety.

- Cheaper than conventional prawn services

- Storage fees are static until full redemption

- Longer pawn/kept period

- No penalties

- Balances of the auction will be returned to the customer.

Guidelines

Application

- Fill up the forms at the Ar-Rahnu counters

- A copy of National Identification Card

- The jewelleries that are being pawned.

- Send to Ar-Rahnu counter for processing and get instant cash.

Installment Payment

- Pay directly to the teller at the counter by only showing the Pawned Letters (Surat Gadaian).

- Unlimited payment times

Full Redemption

- Bring along pawned letters with full redemption payment

- A representative should provide the pawned letters along with the customer’s IC

- Extention of the payment

- Bring the Pawned Letters and storage fees

Lost of Pawned Letters

- Bring the certification letters (Surat Akuan Sumpah) that are certified Pesuruhjaya Sumpah and a copy of Pawned Letters will be given without additional fees.

Posted by T.Jagat at 4:04 PM 0 comments

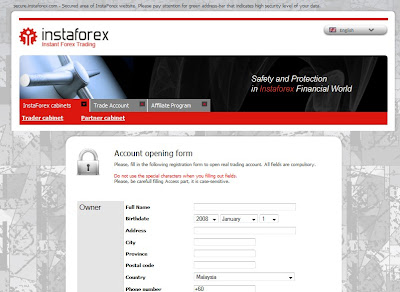

INSTAFOREX : How to open a trading account ?

There are many brokers for forex trading. Here, I will guide you how to open a forex trading account at INSTAFOREX.

1. Go to : https://secure.instaforex.com/en/open-account.aspx?x=LA

You'll see this web.

2. Put down all your particulars in OWNER section.

3. Then, choose your password. It is advise to note it down in your note.

4. In the ACCOUNT section, choose for STANDARD account. Choose SINGAPORE for trading server if you live in South East Asia - because it execute trade much faster. Leverage is up to you. You can choose between 1:2 to 1:1000. If you don't want any commission charge due to overnight trade, you can tick at ISLAMIC ACCOUNT.

5. AFFILIATE CODE - put LA . Then click I AGREE....

Next...click OPEN ACCOUNT (RED BUTTON)

6. Then this page will appear (This is an example for Mr. Abu Bakar trading account)

The very important thing - PLEASE NOTE DOWN THE PIN NUMBER. In this example the PIN NUMBER is : 465035. This pin number is required when you want to withdraw you money from the trading account.

I think that's all. If you have any problem, you can ask me here.

HAPPY TRADING!

Posted by T.Jagat at 1:39 PM 0 comments

Labels: forex, instaforex, trade, trading account

SWIFT code for banks in Malaysia

- Affin Bank Berhad = PHBMMYKL

- Alliance Bank Berhad = MFBBMYKL

- Ambank Berhad = ARBKMYKL

- Bank Simpanan Nasional = BSNAMYKL

- Bumiputra-Commerce Bank Berhad = BCBMMYKL

- CIMB Bank Berhad = CIBBMYKL

- Citibank Berhad Malaysia = CITIMYKL

- Hong Kong Bank Malaysia Berhad = HBMBMYKL

- Hong Leong Bank Berhad = HLBBMYKL

- Malayan Banking Berhad = MBBEMYKL

- OCBC Bank Berhad = OCBCMYKL

- Public Bank Berhad = PBBEMYKL

- RHB Bank Berhad = RHBBMYKL

Posted by T.Jagat at 9:06 PM 0 comments

Labels: bank, swift code

Metatrader 4 Indicator - ICHIMOKU

Ichimoku is one of metatrader 4 (MT4) standard indicator. Sometime it also called Ichimoku Kinko Hyo. Many traders used this indicator to execute trading or to forecast the trade.

Ichimoku consist of 5 separate lines. As you can see in the picture below:

1. (RED LINE)-TENKAN SEN

(HIGHEST HIGH + LOWEST LOW)/2 for the past 9 periods

2. (BLUE LINE)-KIJUN SEN

(HIGHEST HIGH + LOWEST LOW)/2 for the past 26 periods

3. (GREEN LINE)-CHIKOU SPAN

(CURRENT CLOSING PRICE) time-shifted backwards (into the past) 26 periods

4. (UPPER CLOUD)-SENKOU SPAN A

(TENKAN SEN + KIJUN SEN)/2 time-shifted forwards (into the future) 26 periods

5. (LOWER CLOUD)-SENKOU SPAN B

(HIGHEST HIGH + LOWEST LOW)/2 for the past 52 periods time-shifted forwards (into the future) 26 periods

*KUMO – the cloud area between Senkou Span A and Senkou Span B

How to trade with it? I will explain it later in my next post.

Posted by T.Jagat at 12:59 PM 0 comments

Labels: forex, ichimoku, indicator, metatrader 4, MT4, trade

INSTAFOREX & ME - The best broker in Asia!

Cara trading juga dah semakin matang. Kalau dulu, macam nak meletup dada bila trade. Sekarang ni, loss atau win dah tak jadi masalah. Itulah adat trading. Forex ni menuntut kita menggunakan segala atau apa jua cara, tak kisahla teknik apa pun, yang penting untuk mencapai satu matlamat...untuk win atau mendapat keuntungan.

PLATFORM TRADING

Instaforex menyediakan platform Metatrader 4 untuk kita trade. Matawang juga adalah pelbagai, Kebelakangan ini urusniaga logam bernilai seperti emas juga telah ada. Kelebihannya...satu akaun untuk semua. Dalam erti kata lain, tiada makro atau mikro akaun. Semua dalam satu akaun. Akaun trading juga boleh dibuat pilihan untuk free swap.

INTRODUCING BROKER (IB)

Deposit dan withdrawal dengan Instaforex amat mudah sebab mereka menyediakan 6 orang Introducing Broker di Malaysia. Tiga IB mempunyai ofis sendiri di sini. Khidmat mereka memang tiptop (recommended by me!).

Posted by T.Jagat at 8:50 PM 0 comments

Labels: broker, forex, instaforex, introducing broker

Ar Rahnu Agrobank Branches

PERLIS

Simpang Ampat

Lot 1658, Mukim Kayang,

02700 Simpang Empat, Perlis

Tel : 04-9807234 / 04-9807763

Kangar

No. 25, Jalan Indera Kayangan,

01000 Kangar, Perlis.

Tel : 04-9768479 / 04-9768477

KEDAH

Jitra

No. 95, Jalan PJ 3 ,

Kompleks Pekan Jitra 2,

06000 Jitra,

Kedah

Tel : 04-9170120 / 04-9170121

Langkawi

64 / 65, Jln. Pandak Mayah 6, Mukim Kuah,

07000 Langkawi,

Kedah.

Tel : 04-9666931 / 04-9668076

Sik

No. 438, Jalan Tunku lbrahim,

08200 Sik,

Kedah.

Tel : 04-4695282 / 04-4695059

Pendang

Tingkat bawah,

Kompleks Perniagaan Majlis Daerah Pendang,

06700 Pendang,

Kedah.

Tel : 04-7596163 / 04-7596446

Alor Setar

Bangunan Agrobank,

1518-A, Jln Tunku Ibrahim,

05000 Alor Star,

Kedah.

Tel : 04-7332545 / 04-7332558

Guar Cempedak

Lot 318, Jalan Yan,

Pekan Guar Cempedak,

08800 Guar Cempedak,

Kedah.

Tel : 04-4686280 / 04-4687281

Kodiang

No. 81 E. Jalan Jitra.

06100 Kodiang,

Kedah.

Tel : 04-9255137 / 04-9255166

PULAU PINANG

Georgetown

No. 16 & 18, Jalan Tengah,

Taman Sri Tunas,

11900 Bayan Baru,

Pulau Pinang.

Tel : 04-6443604 / 04-6452395

Kepala Batas

No. I & 3, Jalan Bertam,

13200 Kepala Batas,

Pulau Pinang.

Tel : 04-5751422 / 04-5755906

Butterworth

No. 51, Jalan Selat, Taman Selat,

12000 Butterworth,

Pulau Pinang.

Tel : 04-3314539 / 04-3314540

Balik Pulau

No. 858-E, Taman Seri Indah, Jalan Besar,

11000 Balik Pulau,

Pulau Pinang.

Tel : 04-8660912 / 04-8666021

Nibong Tebal

No. 1695 & 1696 Jalan Besar,

14300 Nibong Tebal, Seberang Prai Selatan,

Pulau Pinang.

Tel : 04-5931144 / 04-5933451

PERAK

Pantai Remis

Lot. No. 2190, Jalan Besar,

34900 Pantai Remis,

Perak.

Tel : 05-6771725 / 05-6772352

Tapah

No. 53-B, Jalan Besar,

35000 Tapah,

Perak.

Tel : 05-4014600 / 05-4014601

Bagan Serai

No. 106 & 108, Jalan Besar,

34300 Bagan Serai,

Perak.

Tel : 05-7215377 / 05-7215376

Teluk Intan

No. 42, Medan Mahkota. Jalan Pasar,

36000 Telok Intan,

Perak.

Tel : 05-6222644 / 05-6226816

Kuala Kangsar

No. K6 & K7, Jalan Bendahara,

Bandar Baru,

33000 Kuala Kangsar,

Perak.

Tel : 05-7761155 / 05-7763149

Taiping

No. 37, Tingkat Bawah & Satu,

Market Square,

34000 Taiping,

Perak.

Tel : 05-8089834 / 05-8089835

Setiawan

No. 109 & 110,

Taman Sejati 2 , Jalan Lumut,

32000 Sitiawan,

Perak.

Tel : 05-6917490 / 05-6917487

Grik

No. 109, Jalan Takong Datuk,

33300 Grik,

Perak.

Tel : 05-7913640 / 05-7913655

Seberang Perak

Tingkat Bawah, Bangunan FELCRA Bhd., Bandar Seberang Perak,

36800 Kampung Gajah,

Perak.

Tel : 05-6551089 / 05-6551469

Selama

No. 69, Jalan Besar,

34100 Selama,

Perak.

Tel : 05-8395250 / 05-8395251

Tanjung Malim

No. 60, Jalan Besar,

35900 Tanjung Malim,

Perak.

Tel : 05-4598800 / 05-45998801

SELANGOR

Banting

Lot 4746 & 4747, Jalan Sungai Limau,

45300 Sungai Besar,

Selangor.

Tel : 03-32242522 / 2902 / 3192

Tanjung Karang

Lot 131, Jalan Bomba,

45500 Tanjung Karang,

Selangor.

Tel : 03-32698084 / 03-32698052

Sekinchan

No. 50 & 50A, Jalan Menteri Besar 1,

Sekinchan Business Centre ,

45400 Sekinchan,

Selangor.

Tel : 03-32410326 / 03-32413796

Sungai Buloh

Lot 2380, Jalan 1A / 1,

Bandar Baru Sungai Buluh,

47000 Sungai Buloh,

Selangor.

Tel : 03-61567207 / 03-61567208

Salak Tinggi

No. E061 & E071,

Block No. E Phase 1B,

Cosmoplex Salak Tinggi,

43900 Sepang,

Selangor.

Tel : 03-8706 2153 / 03-8706 2154

Telok Panglima Garang

No. 168, Jalan Utama 2,

Taman Jaya Utama,

42500, Teluk Panglima Garang, Kuala Langat,

Selangor.

Tel : 03-31220982 / 03-31220980

KUALA LUMPUR

Kuala Lumpur

Tingkat 1,

Leboh Pasar Besar,

Peti Surat 13013,

50796 Kuala Lumpur.

Tel : 03-26922754 / 03-26912660

Selayang

No. 142, Jalan 2 / 3 A,

Pusat Bandar Utara,

68100 Batu Caves,

Kuala Lumpur.

Tel : 03-61369469 / 03-61368453

Cheras

No. 65 & 65-1,

Dataran Dwitasik 1,

Bandar Sri Permaisuri,

56000

Kuala Lumpur.

Tel : 03-91732389 / 03-91732387

MELAKA

Bandar Melaka

Wisma Datuk Hj. Mohamad,

Jalan Hang Tuah,

75300 Melaka.

Tel : 06-2844519 / 06-2844537

Jasin

JA 1763, Bandar Baru Jasin,

77000 Jasin,

Melaka.

Tel : 06-5295324 / 06-5293413

NEGERI SEMBILAN

Port Dickson

No. 925, Jalan Lama,

71000 Port Dickson,

Negeri Sembilan.

Tel : 06-6473427 / 06-6474107

Bahau

No. 18 & 19 Jalan Kiara 1

Pusat Perniagaan Kiara

72100 Bahau, Negeri Sembilan.

Tel : 06-4543352 / 06-4546508

Kuala Pilah

Lot 3 & 4, Jalan Hospital,

72000 Kuala Pilah,

Negeri Sembilan.

Tel : 06-4811251 / 06-4814251

Nilai

PT 4698 Jalan TS 1 / 1,

Taman Semarak,

78100 Nilai, Negeri Sembilan

Tel : 06-7993455 / 06-7993473

JOHOR

Pontian

No. 660-1, Jalan Taib,

Wisma Rokijah

82000 Pontian, Johor.

Tel : 07-6871955 / 07-6871958

Batu Pahat

No. 4 & 5, Jalan Mengkudu,

Taman Makmur,

83000 Batu Pahat, Johor.

Tel : 07-4342182 / 07-4348281

Kota Tinggi

No. 16 & 18, Jalan Niaga 2,

Pusat Perdagangan Kota Tinggi,

81900 Kota Tinggi, Johor.

Tel : 07-8832042 / 07-8833471

Muar

63-1, Jalan Ali,

84000 Muar, Johor.

Tel : 06-9523446 / 06-9515625

PAHANG

Kuantan

No. 57 Jalan Tun Ismail.

25000 Kuantan, Pahang.

Tel : 09-5156344 / 09-5158164

Raub

No. 43, Jalan Dato Abdullah.

27600 Raub, Pahang.

Tel : 09-3551 750 / 09-3553 780

Temerloh

F- 58, Jalan Tok Muda Awang Ngah,

Bandar Baru,

28000 Temerloh, Pahang.

Tel : 09-2961877 / 09-2961231

Kuala Lipis

No. 95, Bandar Baru Seberang Jelai

27200 Kuala Lipis, Pahang.

Tel : 09-3123694 / 09-3123695

Triang

No 3, Jalan Bandar,

28300 Triang, Pahang.

Tel : 09-2558570 / 09-2557696

TERENGGANU

Kuala Terengganu Branch

No 106, Jalan Sultan lsmail,

20200 Kuala Trengganu, Trengganu

Tel : 09-6222044 / 09-6222126 / 09-6220139

Dungun Branch

K-42, Jalan Haji Zainal Abidin

23000 Dungun , Terengganu

Tel : 09-8481146 / 09-8482127

Jerteh Branch

Lot 182, Jalan Tuan Hitam,

|22000 Jerteh,

Terengganu

Tel : 09-6971 261 / 09-6971 443 / 09-6972 400 / 09-6972 406

Kemaman Branch

No. KCP 55,

Jalan Sulaimani,

Business Centre Point,

24000 Kemaman,

Terengganu

Tel : 09-8593455 / 09-8593254

Kuala Berang Branch

No. 344, Jalan Besar,

21700 Kuala Berang,

Terengganu

Tel : 09-6811433 / 09-6811434

Cenih Baru Branch

K2 & K3, Bandar Cheneh Baru

24000 Kemaman, Terengganu

Tel : 09-8730 454 / 09-8730 578

KELANTAN

Kota Bharu Branch

Seksyen 12, Jalan Padang Garong,

15000 Kota Bharu, Kelantan

Tel : 09-7440134 / 09-7481211 / 09-7462616

Pasir Puteh Branch

2988-B, Lot 471, Jalan Sekolah Kebangsaan Lelaki,

16800 Pasir Putih, Kelantan

Tel : 09-7867311 / 7862258

Bachok Branch

Lot 294, Bandar Bachok, 16300 Bachok, Kelantan

Tel : 09-7788393 / 09-7788804

Kuala Krai Branch

Lot 1520, Jalan Tengku Zainal Abidin,

18000 Kuala Krai, Kelantan

Tel : 09-9666116 / 09-9663436

Pasir Mas Branch

Lot 308, 128 & 129,

Jalan Pasar Pekan,

17000 Pasir Mas, Kelantan

Tel : 09-7909098 / 09-7900544

Tanah Merah Branch

Lot 82 Tingkat Bawah & Mezzanine,

Jalan Taman Hiburan,

17500 Tanah Merah, Kelantan

Tel : 09-9556100 / 09-9557287

Jeli Branch

Lot Pt 1527, Jalan Kuala Balah,

17600 Bandar Baru Jeli, Kelantan

Tel : 09-9440 252 / 09-9440 886

Gua Musang Branch

Lot PT 993, Bandar Baru Gua Musang,

18300 Gua Musang, Kelantan

Tel : 09-9122 542 / 09-9122 244

SARAWAK

Kuching Branch

Tingkat Bawah & Tingkat 1,

Lot 491 & 492,

Jalan Rambutan,

93400 Kuching,

Sarawak

Tel : 082-410126 / 082-410179 / 082-410671 / 082-410719 / 082-410827

Sri Aman Branch

Sub Lot No.8

Lot 1530, Blok 3,

Jalan Sabu, Peti Surat 354,

95008 Sri Aman,

Sarawak

Tel : 083-321788 / 083-320839 / 083-327944 / 083-327946

Bintulu Branch

Lot 227, Sublot 31,

Parkcity Commerce Square,

Phase III, Jln Tun Ahmad Zaidi

97000 Bintulu,

Sarawak.

Tel : 086-330015 / 086-330016 / 086-313546

Mukah Branch

Sub Lot 59, Medan Setia Raja

96400 Mukah

Sarawak Tel : 084-874048 / 874049

Serian Branch

Lot 291. Serian Bazaar

Off Serian By Pass,

Serian Town District,

94700 Serian,

Sarawak

Tel : 082-876823 / 082-876824

Sabah

Tawau Branch

No. 7, Block N, Jalan Dunlop,

Bandar Sabindo, Peti Surat 60157,

91011 Tawau,

Sabah

Tel : 089-773222 / 089-773291 / 089-773294 / 089-770202

Kota Belud Branch

Lot 3 & 4, Blok E,

Pekan Baru,

89150 Kota Belud,

Sabah

Tel : 088-977141 / 088-975125 / 088-975137

Kota Marudu Branch

Lot 22, Blok D, Pekan Baru Goshen,

Peti Surat 460,

89100 Kota Murudu,

Sabah

Tel : 088-661793

SUMBER: DI SINI

First Post

Salam.

Wallaweiii....setelah jenuh memikirkan nama apa aku nak bubuh kat blog nih...akhirnya nama DENAI EMAS menjadi pilihan. Alhamdulillah...hari ini adalah hari pertama blog ini dilancarkan. Semoga kita beroleh banyak menafaat dan kebaikan di blog ini.

Posted by T.Jagat at 12:42 AM 1 comments

Labels: pengenalan

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)